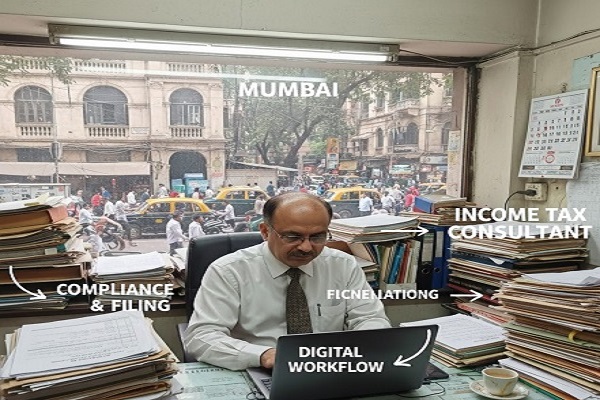

Income Tax Consultant in Mumbai: Expert Services by Clientfirst Professional Services

Managing taxes can be a daunting task, especially with the complexities of Indian tax laws. If you are looking for a reliable Income Tax Consultant in Mumbai, Clientfirst Professional Services is here to provide expert guidance and seamless tax solutions. Our team of seasoned professionals ensures that your tax planning, filing, and compliance are handled efficiently, allowing you to focus on your business or personal goals.

Why You Need an Income Tax Consultant in Mumbai

In today’s fast-paced financial environment, managing taxes without professional help can lead to errors, missed deductions, and even penalties. A trusted Income Tax Consultant in Mumbai can offer multiple benefits, such as:

- Accurate tax filing with zero errors

- Expert guidance on deductions and exemptions

- Assistance with income tax returns for individuals and businesses

- Timely updates on changes in tax regulations

With Clientfirst Professional Services, you get personalized tax solutions designed to minimize liabilities and maximize savings. Our consultants stay updated with the latest tax laws and provide strategies tailored to your financial situation.

Services Offered by Clientfirst Professional Services

At Clientfirst Professional Services, we provide comprehensive tax solutions to meet all your requirements. Our services include:

Individual Tax Filing

Filing your income tax return correctly is crucial to avoid penalties and ensure compliance. Our Income Tax Consultant in Mumbai helps individuals prepare accurate tax returns, taking into account all deductions, exemptions, and rebates available under the Income Tax Act. We handle:

- Salaried employees’ tax returns

- Freelancers and professionals

- Senior citizens with specific tax exemptions

Corporate Tax Solutions

For businesses, staying compliant with tax laws is essential. Our team provides end-to-end support for corporate tax planning and filing. We handle:

- Corporate tax returns and audit support

- GST advisory and compliance

- Payroll and TDS management

Tax Planning and Advisory

Proactive tax planning can help you save money legally. Our consultants advise clients on:

- Investment planning to reduce taxable income

- Retirement planning and tax benefits

- Strategic approaches for property and capital gains tax

Assistance During Tax Notices

Receiving a tax notice can be stressful. Our experts guide clients through the process, offering:

- Representation before tax authorities

- Assistance with response preparation

- Resolution of disputes in compliance with law

Advantages of Choosing Clientfirst Professional Services

Choosing the right Income Tax Consultant in Mumbai ensures peace of mind and optimized tax management. Here’s why clients trust Clientfirst Professional Services:

- Expertise: Our team has years of experience handling diverse tax scenarios.

- Accuracy: We prioritize precision in every filing to prevent errors and penalties.

- Personalized Solutions: Each client receives customized advice based on their financial needs.

- Timely Compliance: We ensure that all tax filings and payments are made on time.

- Confidentiality: Your financial information is handled with the highest level of security and discretion.

Steps to Get Started with Your Tax Filing

Getting started with Clientfirst Professional Services is simple:

- Consultation: Schedule a meeting with our expert Income Tax Consultant in Mumbai.

- Documentation: Share your financial documents, such as income statements, investment proofs, and TDS certificates.

- Review and Strategy: Our consultants analyze your financial data and suggest the best tax-saving strategies.

- Filing and Compliance: We handle the complete filing process, ensuring compliance with all tax laws.

- Post-Filing Support: We provide ongoing support in case of audits, notices, or clarifications.

Tips for Effective Tax Management

Even with professional assistance, understanding the basics of tax management can help you stay ahead. Our experts recommend:

- Maintain organized financial records throughout the year.

- Claim all eligible deductions, such as investments under Section 80C.

- Review your tax liabilities periodically, especially if you have multiple income sources.

- Seek professional help for complex tax scenarios, such as capital gains or business taxation.

Following these tips with guidance from an experienced Income Tax Consultant in Mumbai ensures stress-free compliance and better financial planning.

Clientfirst Professional Services: Commitment to Excellence

At Clientfirst Professional Services, we believe in providing high-quality, reliable, and transparent tax services. Our approach combines professional expertise with personalized attention, making us a trusted choice for individuals and businesses in Mumbai. Our consultants are committed to:

- Staying updated with evolving tax laws and regulations.

- Offering proactive advice to minimize tax liability.

- Maintaining ethical practices and full transparency in all dealings.

By partnering with us, clients can confidently navigate the complexities of taxation while optimizing their financial outcomes.

Common Questions About Income Tax Consulting

How do I choose the right income tax consultant in Mumbai?

Look for professionals with experience, proven results, and positive client feedback. A qualified consultant should understand your specific tax situation and provide customized solutions.

Can tax consultants help with both individual and corporate tax returns?

Yes, experienced consultants like those at Clientfirst Professional Services handle a wide range of tax services, from personal returns to corporate filings.

What documents are required for tax filing?

Key documents include salary slips, Form 16, bank statements, investment proofs, and any other supporting documents relevant to deductions and exemptions.

Are tax consultations confidential?

Absolutely. Trusted consultants maintain strict confidentiality and secure handling of all client information.

Conclusion

Choosing a reliable Income Tax Consultant in Mumbai is essential for accurate tax filing, strategic planning, and compliance with tax laws. Clientfirst Professional Services offers expert guidance, personalized solutions, and peace of mind to both individuals and businesses. From filing income tax returns to handling complex corporate taxation, our team ensures your finances are managed efficiently and legally.

By trusting Clientfirst Professional Services, you gain more than just a tax consultant – you gain a financial partner dedicated to optimizing your tax strategy, saving money, and ensuring compliance.

Take the first step toward hassle-free tax management today by consulting with a leading Income Tax Consultant in Mumbai at Clientfirst Professional Services. Your taxes are in expert hands, giving you the freedom to focus on your personal and professional growth.